BTC Price Prediction: $500K Institutional Target in Play as Technicals Flash Bullish

#BTC

- Technical Strength: BTC holds above critical moving averages with MACD confirming bullish momentum

- Institutional Divide: El Salvador's pro-Bitcoin moves offset by corporate hesitancy (GameStop)

- Price Discovery Phase: Break above $120.8K could accelerate toward all-time highs

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Builds Above Key Support

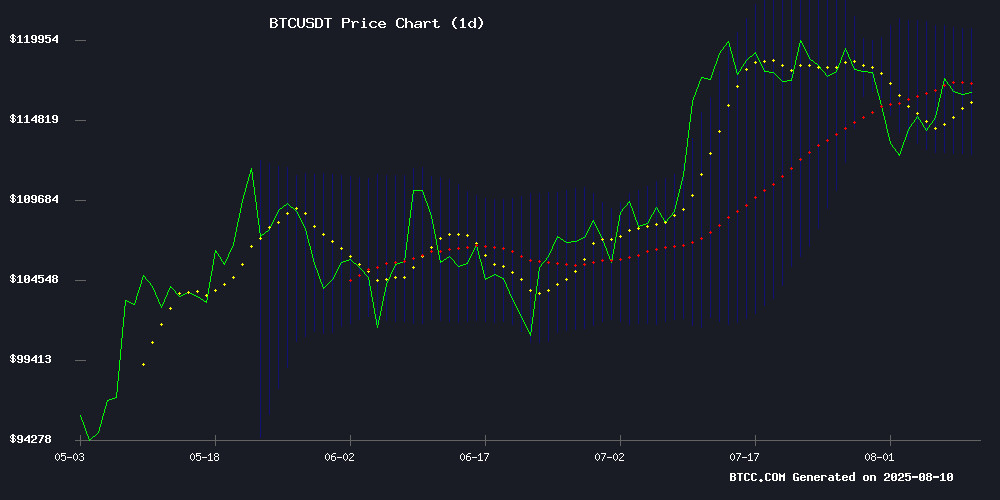

BTC is currently trading at $118,634.60, firmly above its 20-day moving average ($116,754.53), signaling strong bullish momentum. The MACD indicator shows a positive crossover (2036.83 vs. 1378.91), reinforcing upward potential. Bollinger Bands indicate volatility expansion with price hugging the upper band ($120,862.98), suggesting continuation of the uptrend. 'The $116K level has transformed from resistance to support,' says BTCC analyst Ava. 'A clean break above $120.8K could trigger a parabolic move.'

Mixed Sentiment as Institutional Adoption Grows Amid Regulatory Headwinds

El Salvador's $50M Bitcoin bank framework and Tuur Demeester's $500K prediction contrast with GameStop's crypto retreat and Glassnode's fragility warnings. 'Institutional bulls are fighting short-term profit-taking,' notes Ava. ETF outflows (-$117M this week) haven't broken BTC's technical strength, with the Winklevoss-Trump mining venture highlighting growing political acceptance. The market is digesting these opposing forces at a critical technical juncture.

Factors Influencing BTC's Price

El Salvador Sets $50M Capital Requirement for Bitcoin Investment Banks

El Salvador has enacted a new Investment Bank Law, permitting licensed institutions to hold Bitcoin and cater exclusively to professional investors. The legislation mandates a $50 million capital reserve and requires clients to maintain at least $250,000 in unrestricted funds.

The move aims to position the country as a hub for institutional crypto activity, focusing on complex financial services like asset management and corporate advisory. Unlike traditional banks, these entities will operate under a separate regulatory framework overseen by the Central Reserve Bank.

By restricting services to sophisticated investors—defined as those with substantial market knowledge and risk assessment capabilities—the law creates a controlled environment for Bitcoin adoption at an institutional level. This strategic play seeks to attract global capital while mitigating systemic risks.

GameStop Halts Bitcoin Accumulation as CEO Ryan Cohen Distances from Crypto

GameStop's abrupt retreat from Bitcoin investments has sparked market speculation after CEO Ryan Cohen unfollowed all Bitcoin-related accounts on social media platform X. The video game retailer, which amassed $500 million in BTC earlier this year, now holds $8.5 billion in cash reserves against a $10 billion market capitalization.

The company's cryptocurrency strategy launched with considerable fanfare in March 2025 when its board unanimously approved Bitcoin as a treasury reserve asset. This decision followed months of speculation fueled by Cohen's February meeting with MicroStrategy founder Michael Saylor, a prominent Bitcoin advocate.

Market observers note the timing coincides with GameStop's completion of a $1.5 billion convertible notes offering in April, featuring 0% interest and 2030 maturity. These funds were ostensibly earmarked for Bitcoin purchases and general corporate purposes, yet BTC accumulation ceased abruptly in May.

Bitcoin Poised for Potential All-Time High Amid Bullish Technical Patterns

Bitcoin's price trajectory suggests a potential surge to unprecedented levels this week, with the cryptocurrency consolidating near the critical $118,000 resistance zone. Market structure reveals a textbook bullish flag formation on daily charts—a pattern historically preceding explosive breakouts.

The flag's pole measures $25,000 from June's $98,320 low to July's $123,200 peak. A confirmed breakout above $117,000 could propel BTC toward $142,000, calculated by adding the pole's height to the breakout point. Technical confirmation comes from the asset maintaining position above the 100-day exponential moving average while completing a break-and-retest of its previous all-time high at $112,000.

Institutional participation remains a key driver, with spot Bitcoin ETF inflows demonstrating sustained demand. The convergence of technical and fundamental factors creates what analysts describe as a 'compelling setup' for price discovery.

Bitcoin Rebound Holds $116K but Faces Fragile Zone, Warns Glassnode

Bitcoin's record-breaking rally above $123,000 in mid-July has given way to a choppy and uncertain phase. The price has slipped to $116,191, showing minimal change over the past 24 hours but up 0.65% over the week.

The pullback has pushed BTC into a thinly traded 'air gap' between $110,000 and $116,000, an area where few coins have historically changed hands. This lack of liquidity leaves the market vulnerable to sharper swings, yet it may also present accumulation opportunities for patient buyers.

According to Glassnode data, the decline from the all-time high has left many new investors holding coins purchased above $116,000. This cluster of supply has become a significant overhead barrier. Attempts to reclaim it have so far failed, with $116,900 now acting as a decisive resistance level.

Short-term holder profitability has slipped to 70%, signaling cooling but steady sentiment. The cost basis at $106,000 remains supportive, aligning with historical bull market patterns.

BTC Resistance Levels Strengthen as Price Eyes $120K

Bitcoin's upward surge continues to dominate market attention, with the cryptocurrency breaking through key resistance levels to trade above $115,500. The asset now appears poised for a potential run at the psychologically significant $120,000 mark.

Technical indicators reinforce the bullish case. A rising trend line on hourly charts establishes strong support near $115,600, while the price maintains its position above the 100-hourly moving average. The $117,500 resistance level emerges as the next critical threshold—a decisive breakout could pave the way for testing $118,250.

Market dynamics show traders taking profits after an intraday high of $117,643, but underlying momentum remains intact. This consolidation phase follows Bitcoin's recovery from an early dip to $112,200, demonstrating the market's continued appetite for the digital asset.

Crypto's Dark Role in Modern Warfare

Cryptocurrency, once celebrated as a beacon of financial freedom, has emerged as a critical tool in modern conflict zones. From North Korea's ballistic missile programs to militant financing in Gaza, digital assets are reshaping the battlefield. Decentralized networks that empower dissidents also enable sanctioned regimes and armed groups to bypass traditional financial scrutiny.

Hamas openly solicits crypto donations for operations, while North Korea's Lazarus Group has siphoned billions through cyber heists—funds allegedly diverted into nuclear development. The Ukraine-Russia war further illustrates crypto's dual nature: both nations have leveraged Bitcoin and other assets to fund military efforts, blurring the line between store of value and weapon of war.

Blockchain analytics reveal millions flow regularly to military projects. Russian and Ukrainian grassroots campaigns mirror Hamas' crypto fundraising playbook. Meanwhile, North Korean and Israeli hackers employ theft as their primary on-ramp for digital asset accumulation—with Pyongyang's nuclear ambitions standing as the most alarming use case.

El Salvador Advances Bitcoin Integration with New Investment Bank Framework

El Salvador continues to defy traditional financial institutions by deepening its commitment to Bitcoin. The nation has authorized investment banks to hold Bitcoin exclusively for sophisticated investors, marking another milestone in its pro-crypto agenda. This move, enabled by the PSAD license, allows private banks to operate in both legal tender and digital assets.

The country's Bitcoin reserves now stand at 6,262 BTC, valued at over $730 million. Meanwhile, El Salvador is forging international alliances with Bolivia and Pakistan to promote broader crypto adoption. These developments occur against a backdrop of ongoing tension between progressive crypto policies and institutional skepticism from organizations like the IMF.

Bitcoin Veteran Tuur Demeester Predicts $500K Target Amid Institutional Bull Run

Bitcoin economist Tuur Demeester and Adamant Research posit that the cryptocurrency is in a phase of 'quiet strength,' signaling a mid-cycle pause before what could evolve into one of its most historic bull runs. The report projects a potential 4–10x appreciation from current levels, implying targets exceeding $500,000 per BTC in the coming years.

On-chain data reveals steadfast conviction among long-term holders, with whales refraining from large-scale sell-offs despite market volatility. Notably, the HODLer Net Position Change shows no capitulation in 2025—a stark contrast to behavior typically observed at market peaks. 'Whales moved coins during the US election turbulence, but 2025 has seen no net outflow from seasoned investors,' the analysis notes.

Best Crypto to Buy as El Salvador Opens the Door to Bitcoin Banks

El Salvador has enacted its new Investment Banking Law, permitting private banks to hold Bitcoin and other digital assets with a $50 million minimum capital requirement. Licensed institutions can now offer crypto services—including custody, trading, and operating as full-fledged Bitcoin banks—to accredited investors. This structural shift separates investment banks from commercial banks, streamlining Bitcoin integration.

President Nayib Bukele's administration continues to expand Bitcoin's institutional footprint, signing crypto partnerships with Bolivia and exploring mining initiatives. The move signals growing appeal for institutional capital and could catalyze adoption-driven projects tied to Bitcoin's ecosystem.

Winklevoss Twins Back Trump-Linked Bitcoin Mining Venture

Cameron and Tyler Winklevoss have made a strategic private investment in American Bitcoin, a mining company co-founded by Donald Trump Jr. and Eric Trump. The move deepens their ties to both the crypto industry and political circles aligned with the former president.

The Gemini exchange founders' investment amount remains undisclosed, but the timing coincides with American Bitcoin's planned public debut via merger with Gryphon Digital Mining. This follows the twins' $2 million donation to Donald Trump's 2024 campaign and their participation in White House crypto policy discussions.

Their growing political engagement was further evidenced by attendance at the July signing of the GENIUS Act, signaling a concerted push to influence digital asset regulation. The investment reinforces Bitcoin's evolving role at the intersection of finance and politics.

Bitcoin Maintains Strength Above $117K Despite ETF Outflows as Technicals Signal Bullish Momentum

Bitcoin demonstrates resilience at $117,866, shrugging off recent ETF outflows with technical indicators pointing to sustained bullish potential. The neutral RSI reading of 57.25 leaves ample room for upward movement, while regulatory tailwinds provide structural support.

President Trump's executive order enabling 401(k) investments in digital assets has emerged as a game-changer, potentially unlocking $9 trillion in retirement capital. This long-term catalyst outweighs short-term pressures from Fidelity's $99.1 million ETF outflow and profit-taking by long-term holders below $114,000.

The market appears to be digesting conflicting signals - institutional uncertainty versus structural adoption drivers. Bitcoin's ability to recover from a 6.7% weekly decline underscores underlying demand, with technicals confirming the bullish case remains intact despite episodic volatility.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $150K | $210K | $300K | ETF inflows, halving aftermath |

| 2030 | $250K | $500K | $750K | Global reserve asset status |

| 2035 | $400K | $1M | $2.5M | Full monetary network effects |

| 2040 | $600K | $3M | $5M+ | Plan B adoption scenarios |

Ava cautions: 'These projections assume sustained institutional adoption. Watch the $116K support - losing it invalidates the near-term bullish case.'